If the property was brought in the year 2000, the gain on the sale will be considered as a long term capital gain. For more information see Capital Gains Tax (CGT). Long term capital gain is the difference between the indexed cost of acquisition and the sale price.

Capital Gains Tax Rates for Fiscal Year 201718 (Assessment Year 201819). The part of any net capital gain from selling Section 1250 real property that is required to be recaptured in excess of straight-line depreciation is taxed at a maximum 25% rate. A capital gains tax (CGT) is a tax on the profit realized on the sale of a non-inventory. Specifically, for individual taxpayers, gross income does not include 50% of any gain from the sale or exchange of “qualified small business stock” held for more than 5 years. Mr Y has sold residential house property in May 2017 long term capital gain.

#Capital gain 2017 code

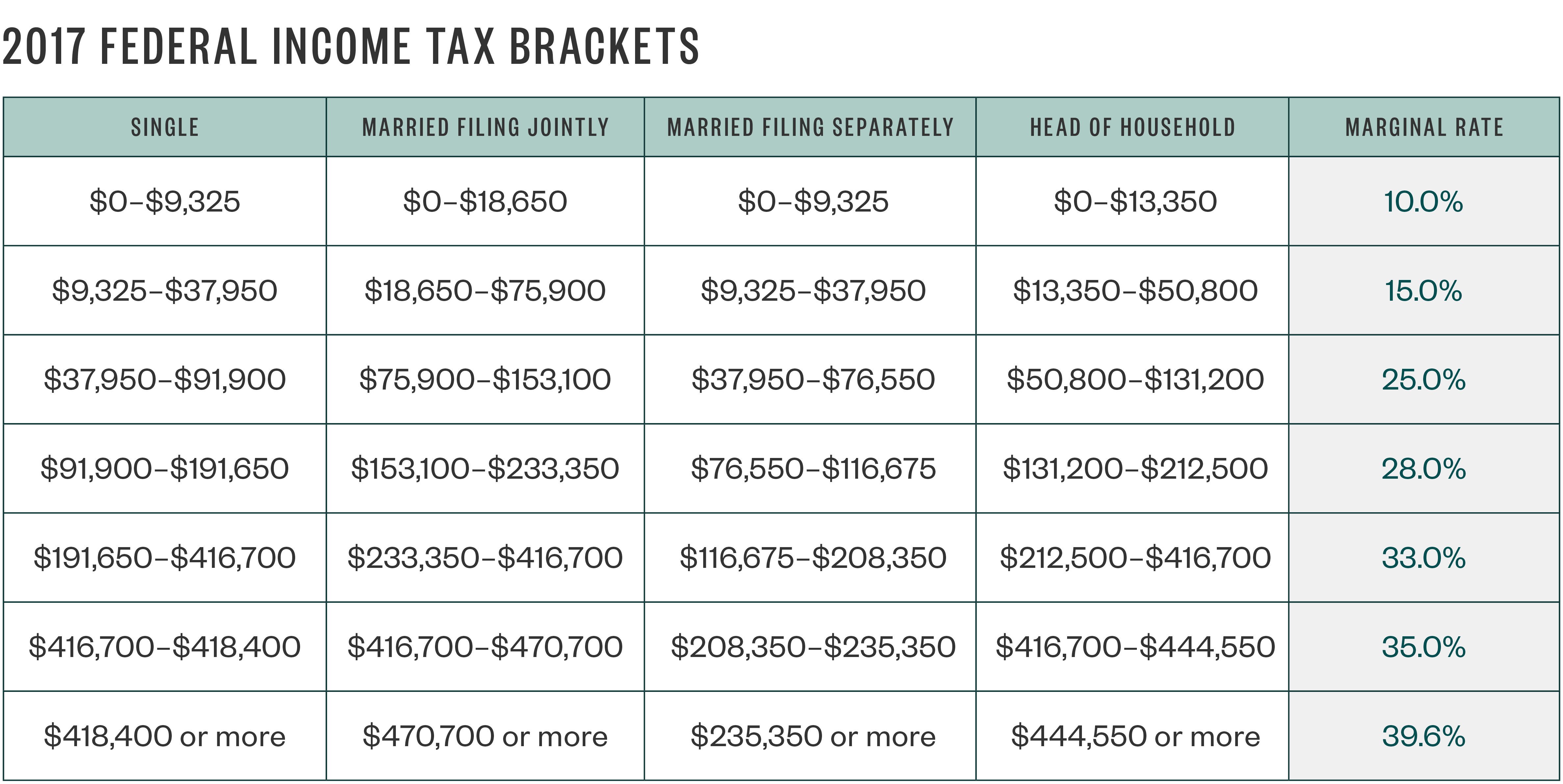

The taxable part of a gain from selling Internal Revenue Code Section 1202 qualified small business stock is taxed at a maximum 28% rate. No capital gain is applicable when an asset is inherited because there is no. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate. Capital gains rates for individual increase to 15% for those individuals in the 25% - 35% marginal tax brackets and increase even further to 20% for those individuals in the 39.6% marginal tax bracket. Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gain may be taxed at 0%, if an individual is in the 10% or 15% marginal tax bracket. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than the sum of your net short-term capital loss and any long-term capital loss carried over from the previous year. If you have a net capital gain, that gain may be taxed at a lower tax rate than the ordinary income tax rates. If you hold it one year or less, your capital gain or loss is short-term.Ĭapital gains and deductible capital losses are reported on Form 1040. If you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. Losses from the sale of personal-use property, such as your home or car, are not deductible.Ĭapital gains and losses are classified as long-term or short-term.

You have a capital loss if you sell the asset for less than your basis. You have a capital gain if you sell the asset for more than your basis. When a capital asset is sold, the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital loss. 1 Examples are a home, household furnishings, and stocks or bonds held in a personal account. Almost everything owned and used for personal or investment purposes is a capital asset.

0 kommentar(er)

0 kommentar(er)